On November 11th, we held a workshop with EventVestor, ExtractAlphla, and Boardroom Alpha on the importance of tracking estimated versus confirmed future earnings dates, the signals provided by advances or delays in confirmation timing, and broader use cases for forward-looking event data beyond earnings.

We also discussed crowdsourced earnings predictions for EPS and revenues and how boardroom/executive activity can serve as a complementary lens for understanding corporate behavior and market dynamics.

Anju Marempudi, CEO of EventVestor

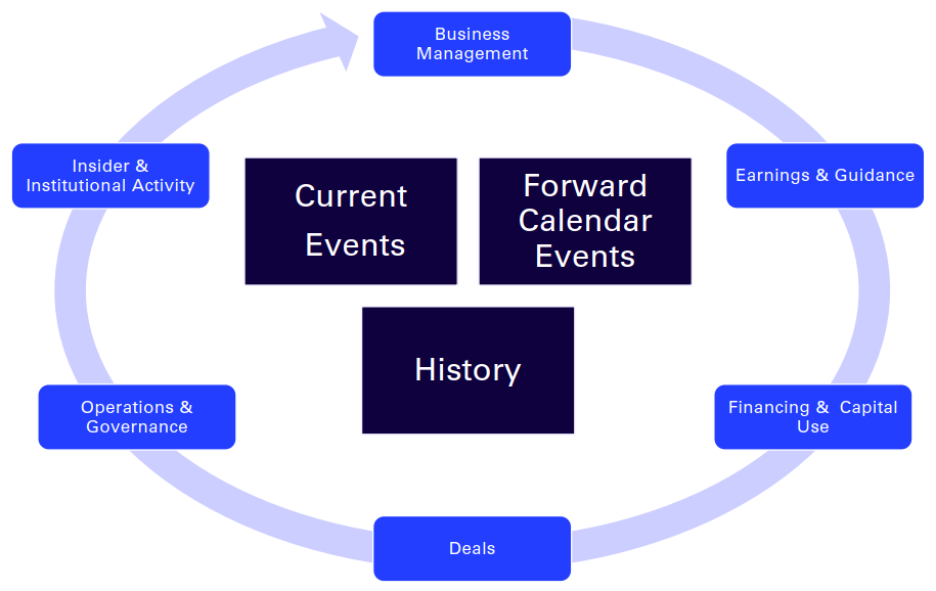

Anju provided a comprehensive overview of how structured events data can serve as an early indicator of corporate performance, investor sentiment, and market-moving activity. His presentation emphasized the growing need for timely, high-quality event intelligence—not just for tracking earnings-related announcements, but for understanding the broader information environment surrounding public companies.

Anju began by explaining that EventVestor’s platform captures and structures a wide range of corporate and investor events across thousands of public companies, including:

- Earnings date announcements and confirmations (with changes or delays tracked as potential sentiment signals);

- Investor days, broker-hosted conferences, and analyst events;

- Corporate guidance updates, M&A announcements, and shareholder actions;

- Executive changes such as CEO/CFO transitions, board reshuffles, and activism-related turnover.

He stressed that these events are timestamped, normalized, and categorized to make them easily searchable and backtestable for both discretionary and quantitative use cases. Analysts can use these data points to build predictive signals, monitor forward events calendars, and understand how companies communicate with investors over time.

In the Q&A session, Anju confirmed that EventVestor tracks C-suite appearances at industry events and captures detailed participation data for all major corporate and investor conferences, noting which executives are presenting and which companies are represented.

He added that EventVestor also records CEO appearances on CNBC and Bloomberg TV, recognizing that such visibility events can sometimes signal forthcoming announcements or reflect management’s desire to influence market perception. For example, increased CEO visibility in the media often aligns with major product launches, earnings pre-announcements, or other corporate milestones.

Anju acknowledged that while EventVestor currently focuses on CNBC and Bloomberg appearances, the company is exploring ways to expand this coverage to include industry-specific and nontraditional media platforms, where executives increasingly communicate outside the usual investor relations channels.

He also elaborated that because 13F filings are typically six weeks delayed, their standalone value is limited for short-term signal generation. However, by aligning those filings with the timeline of company-specific events—such as M&A activity, leadership changes, or major product launches—EventVestor users can backtest how specific announcements may have influenced institutional buying or selling behavior. This approach enables analysts to identify causal relationships between investor actions and corporate events, rather than viewing 13Fs as static, backward-looking disclosures.

Willet Bird, Chief Revenue Officer of ExtractAlpha

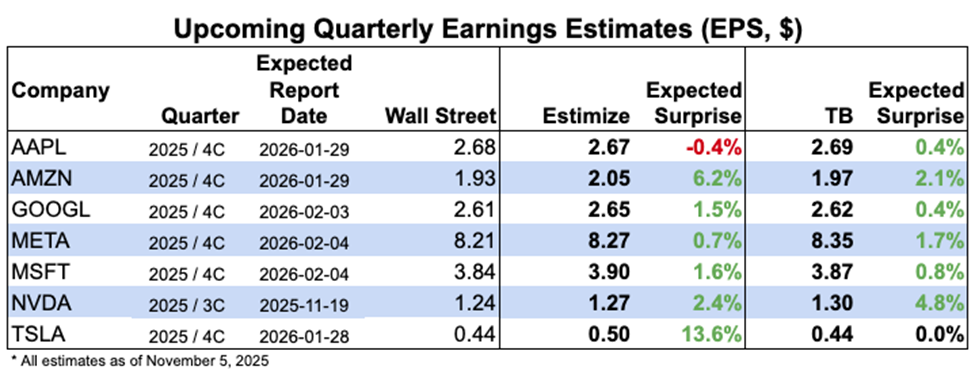

Willett presented a detailed overview of how investors can leverage predictive analytics and alternative data to anticipate earnings results and understand market reactions. He began with TrueBeats, a dataset built to forecast earnings and revenue surprises before they are announced. TrueBeats combines three proprietary indicators — ExpertBeat (tracking analyst sentiment), TrendBeat (peer and momentum analysis), and ManagementBeat (management tone and guidance behavior) — to generate pre-earnings predictions.

Willett shared examples from large-cap technology names, showing how TrueBeats successfully anticipated positive and negative surprises, demonstrating its value as a real-time predictive signal that captures subtle behavioral cues missed by traditional models.

He then discussed Estimize, the crowdsourced earnings and revenue estimate platform with over 100,000 contributors, including professional analysts and independent investors. Unlike Wall Street consensus, which often reflects a narrower institutional view, Estimize aggregates a broader, more dynamic set of forecasts.

Willett showed how divergence between Estimize and sell-side consensus can create alpha opportunities — particularly when Estimize expectations are higher and the company only meets traditional analyst forecasts. During Q&A, Willett confirmed that academic studies show stronger stock reactions when results exceed Estimize expectations, as the Estimize crowd tends to represent more informed and responsive sentiment.

Willett also introduced the Sell-Side Coverage Matrix, an upcoming ExtractAlpha product that maps relationships between companies based on overlapping analyst coverage. Traditional sector classifications like GICS can be too rigid, while this matrix reveals hidden linkages between companies that share analysts but operate in different industries.

These relationships often signal correlated sentiment or risk that investors might otherwise overlook. By quantifying shared coverage networks, ExtractAlpha aims to give clients a more dynamic way to model risk, uncover peer signals, and build smarter cross-sectional relationships for both quantitative and discretionary strategies.

In closing, Willett emphasized that ExtractAlpha’s datasets—TrueBeats, Estimize, and the Sell-Side Coverage Matrix—work best when integrated together. TrueBeats provides predictive power ahead of earnings, Estimize offers a forward-looking sentiment benchmark, and the Coverage Matrix contextualizes relationships among firms. Together, they form a multi-layered view of market expectations and company dynamics.

Michael Strauss, Director at Boardroom Alpha

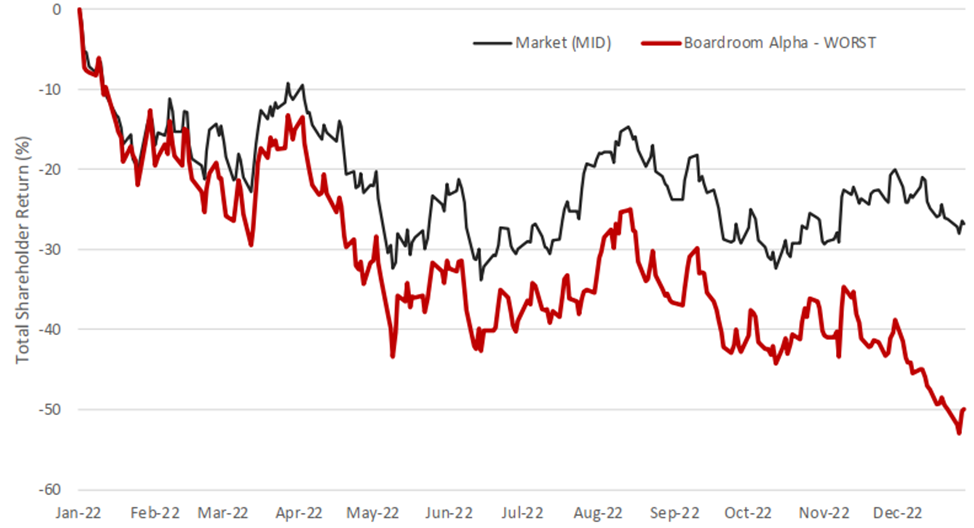

Michael discussed how leadership quality and corporate governance data can be systematically measured to generate investable insights. His discussion centered on Boardroom Alpha’s Leadership Scores, a dataset designed to evaluate the performance and credibility of C-suite executives and board directors across U.S. public companies.

He explained that these ratings—covering CEOs, CFOs, and board members—are built from a blend of quantitative and qualitative inputs, including company fundamentals, stock performance, and event-driven data such as M&A activity, executive changes, and shareholder actions. The goal, he noted, is to quantify management’s real-world effectiveness and accountability over time.

Michael outlined how the Leadership and Team Scores are updated on a monthly cadence, ensuring that the metrics remain timely and responsive to both corporate and market developments. He clarified during the Q&A that although company fundamentals (like earnings and financial results) are typically released quarterly, the inclusion of stock price behavior and governance events allows for more frequent recalibration.

Importantly, when a new executive or director joins a company, Boardroom Alpha waits for two quarters before issuing a rating, ensuring enough data accumulates to assess performance without noise. This methodology balances recency and reliability, reducing false signals from short-term market volatility or incomplete tenures.

He further described how Boardroom Alpha integrates governance events—such as director departures, activist involvement, and compensation changes—into its scoring models. The system identifies red flags such as repeated underperformance, high executive turnover, or board entrenchment, which may signal governance risk or weak oversight. Conversely, improvements in leadership stability or positive corporate actions (like insider buying or shareholder-friendly moves) can lead to upward score revisions.